Offchain reporting

From Chainlink Community Wiki

Price Feeds Off-chain Reporting (OCR)

Migrating from FluxMonitor to Offchain Reporting was by far the most impressive upgrade, and the increase in efficiency was, and is, simply amazing.

The migration resulted in an exponential increase in efficiency and an overall easier experience as a Chainlink Node Operator.

Migration to Off-chain Reporting: ETH / USD

- Oct 21: The Proxy is updated to point to the OCR Contract, with the FluxMonitor contract as a failover.

- 11 May 21: The first transmissions for the ETH / USD Price Feed were broadcast on-chain.

- 06 May 21: The ETH / USD AccessControlledOffchainAggregator contract was deployed

- at address 0x37bC7498f4FF12C19678ee8fE19d713b87F6a9e6

- at transaction hash 0x3442b045dde57720c72992dbc2dfd4ea0c608bdbe1d561cb584c1e2681e9edc7

Off-chain Reporting (OCR) Operational Overview:

The OCR feeds are designed with access control and high availability in mind.

In case of a contract or network failure, there are failover points designed into the system.

In the details below, we will be looking at the ETH / USD price feed.

The following example is specific to a standard price feed. It’s important to note that there are numerous specific use-case contracts in production that may have different designs, but the general contract design will remain applicable.

Important Definitions:

Deviation Threshold:

The value that an asset needs to deviate from the previously reported value.

Maintaining the example of the ETH / USD price feed, if the AccessControlledOffchainAggregators most recently reported value of Ethereum is 451804000000 or $4,518.04, and a single Chainlink node operator’s calculated value deviates from that value greater than 0.5% (± 2259020000 or ± $22.59), a new round will be fired and the new aggregate value will be written to chain.

Heartbeat:

Maximum age of an on-chain asset value.

If the deviation threshold is not reached within the time of the heartbeat, the feed will be updated. The heartbeat for the ETH / USD feed is one hour. For example, if the price of Ethereum is stable and does not deviate greater than 0.5% within an hour, a new round will be fired off regardless of the deviation threshold.

Observer:

For each round of a price feed, each Chainlink node is responsible for submitting observations. These observations are an aggregate of multiple data sources; typically a median.

For each round a Chainlink node participates in, they’re rewarded an observation payment. LINK token

Transmitter:

While every Chainlink node is expected to participate in observations, only one Chainlink node is (initially) pseudo-randomly elected to transmit the agreed upon aggregate value that is calculated from all observations.

The transmitter is compensated for their observation, reimbursed for the gas fees spent on broadcasting the transaction, and is rewarded a transmitter bonus.

If the initial transmitter is unable to transmit the transaction within a reasonable time, two additional transmitters are elected, creating a race condition.

Contract Descriptions:

There are three major contracts to be aware of:

- EACAggregatorProxy

- SimpleWriteAccessController

- AccessControlledOffchainAggregator

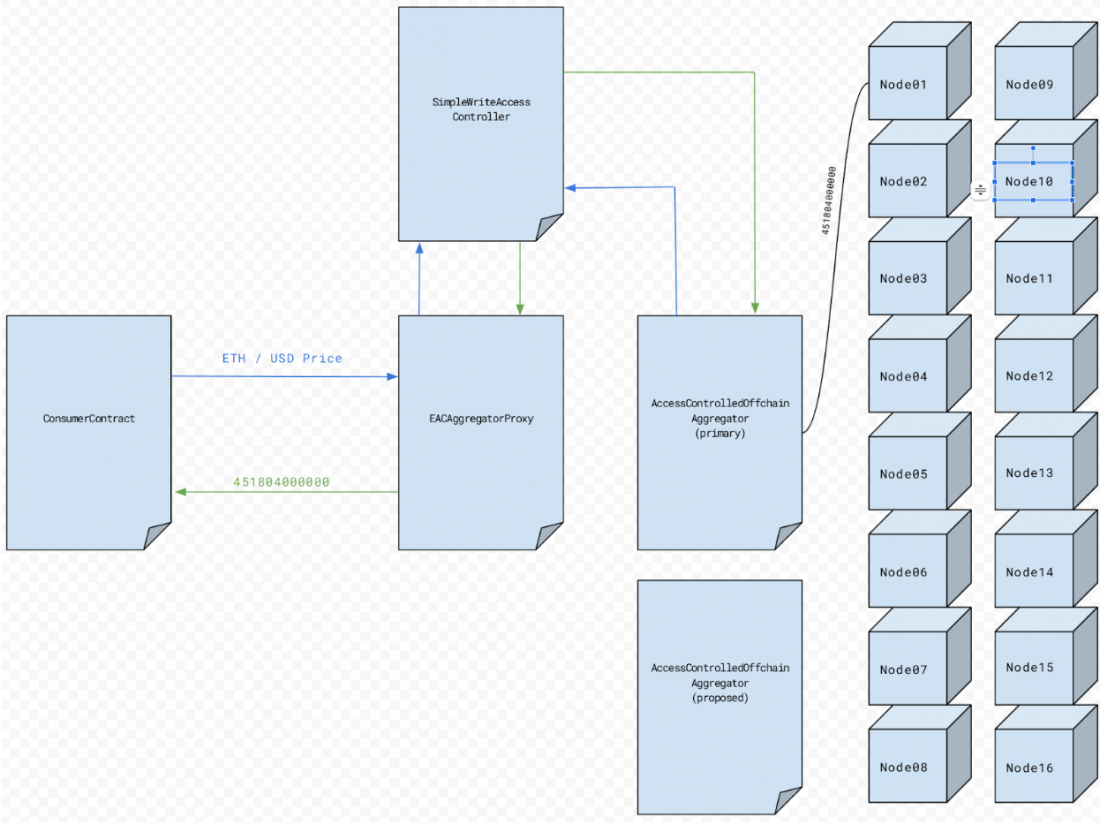

EACAggregatorProxy:

This is the proxy contract that consumer contracts will read data from. This contract is designed to enable an active passive data source. If we take a look at the aggregator that the ETH / USD proxy points to, we’ll see that it is the address of the ETH / USD AccessControlledOffchainAggregator.

It gets a little obfuscated if we look at the proposedAggregator, as that shows as 0x0000000000000000000000000000000000000000. However; this is tied to a flag contract, the operation of which is outside the scope of this documentation. The important takeaway is that the proxy tentatively points at a backup price feed that is almost identical to the primary, but is highly secure.

AccessControlledOffchainAggregator:

This is the contract that node operators provide price updates to. If we take a look at the ETH / USD example above (0x37bC7498f4FF12C19678ee8fE19d713b87F6a9e6), we can see quite a few getters for this contract.

We’ll focus on three of these in this documentation.

- description

- latestAnswer

- requesterAccessController

We can see that the description is ETH / USD.

We can see that the latestAnswer is 451804000000.

- If we adjust for decimal places, we’ll know that the price of Ethereum during this round was $4,518.04.

We can see that the contract is referencing another contract, the requesterAccessController at address 0x641b698ad1c6e503470520b0eecb472c0589dfe6.

SimpleWriteAccessController:

The SimpleWriteAccessController’s purposes is to control which contracts can read and/or write to a contract. Read and write access for both the EACAggregatorProxy and the AccessControlledOffchainAggregator can be managed by the SimpleWriteAccessController.

To manage access, there is an AccessList in the SimpleWriteAccessController that will track which contracts are able to read and/or write to/from the EACAggregatorProxy and AccessControlledOffchainAggregator.

In short, this enables the contract owner to have data on-chain which is only accessible to the desired contracts.

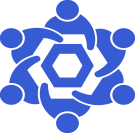

Diagrams:

In this section, you will find diagrams representing the relationships between each of the above contracts.

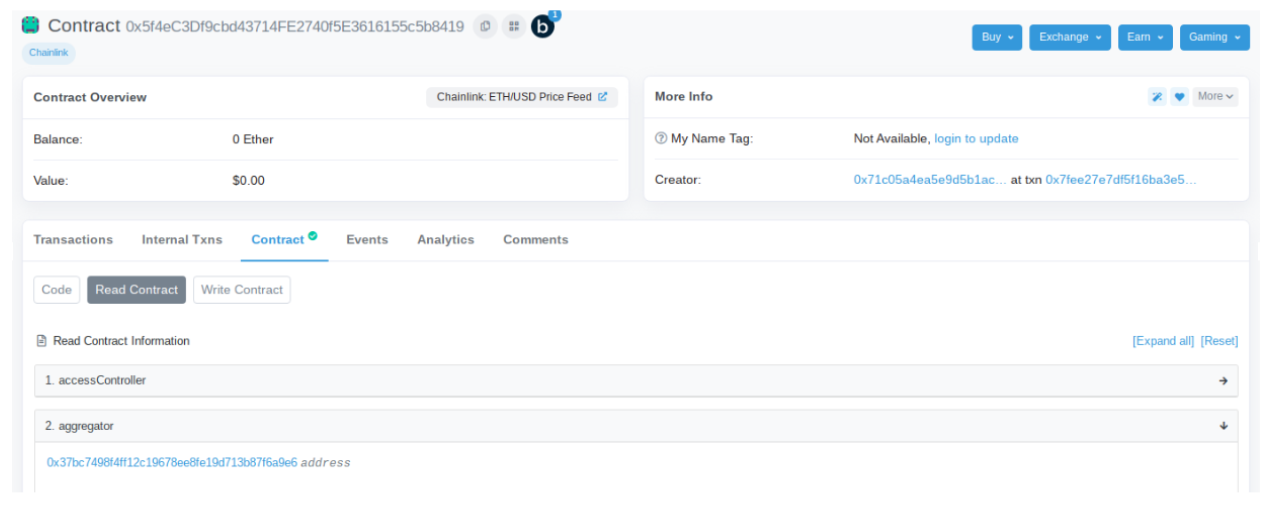

SimpleWriteAccessController:

Here we can see the ConsumerContract requesting the latest round data from the EACAggregatorProxy contract. Before the EACAggregatorProxy provides the response to the ConsumerContract, it will check the SimpleReadAccessControl function in the SimpleWriteAccessControl contract. It will compare the requesting ConsumerContract’s address against the AccessList. If the requesting ConsumerContract address is found in the AccessList, it will be able to read the lastestRound response from the EACAggregatorProxy.

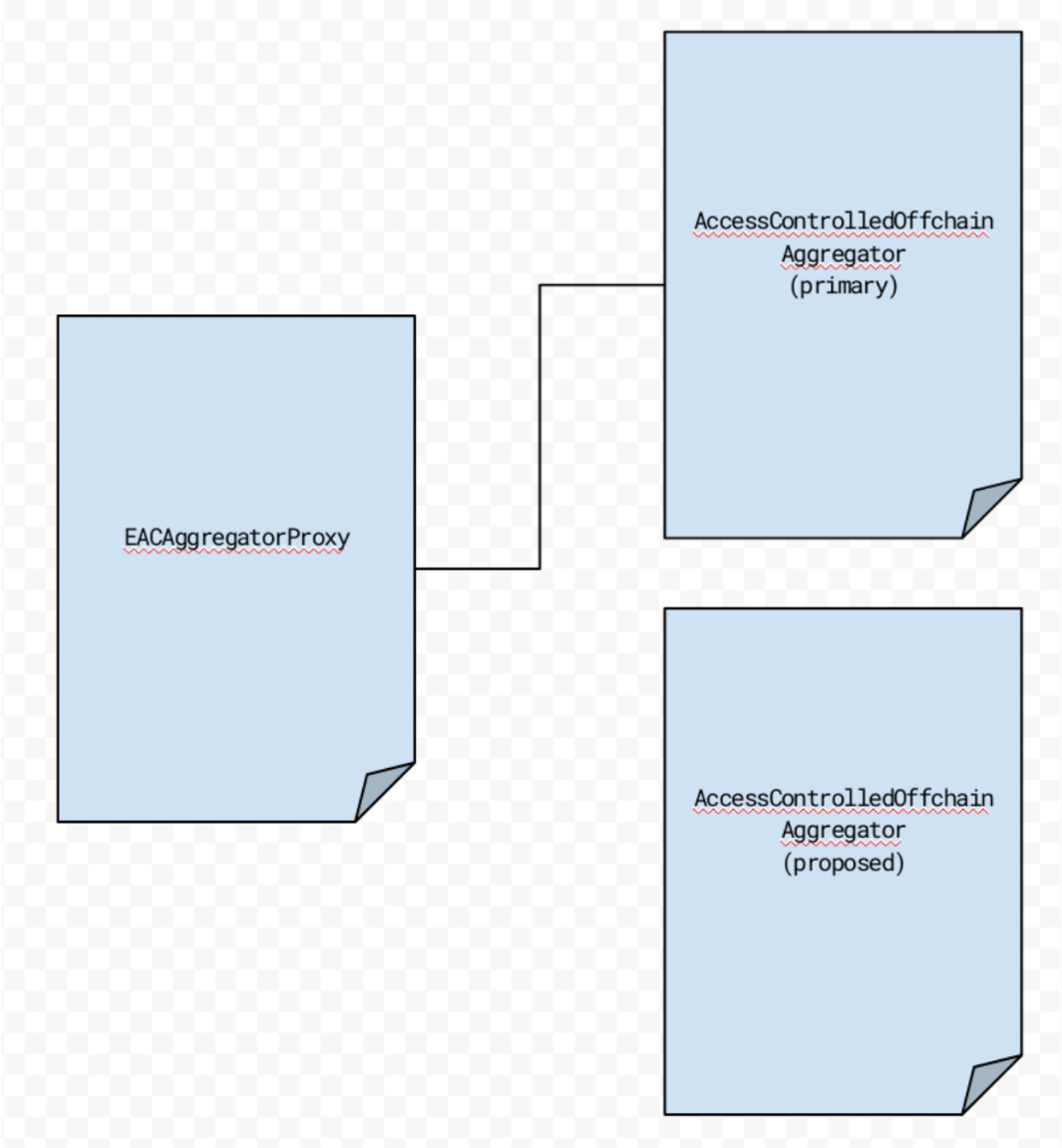

EACAggregatorProxy Failover Design:

Here we can see the proxy contract pointing at the primary aggregator. In case of a failure event, the proxy contract can be pointed to another aggregator contract, without the consumer having to make any adjustments on their end.

AccessControlledOffchainAggregator

The AccessControlledOffchainAggregator is the contract that each Chainlink node interacts with.

At the contract level, the AccessControlledOffchainAggregator tracks quite a bit of information.

For the purpose of this document, we will highlight a couple of them:

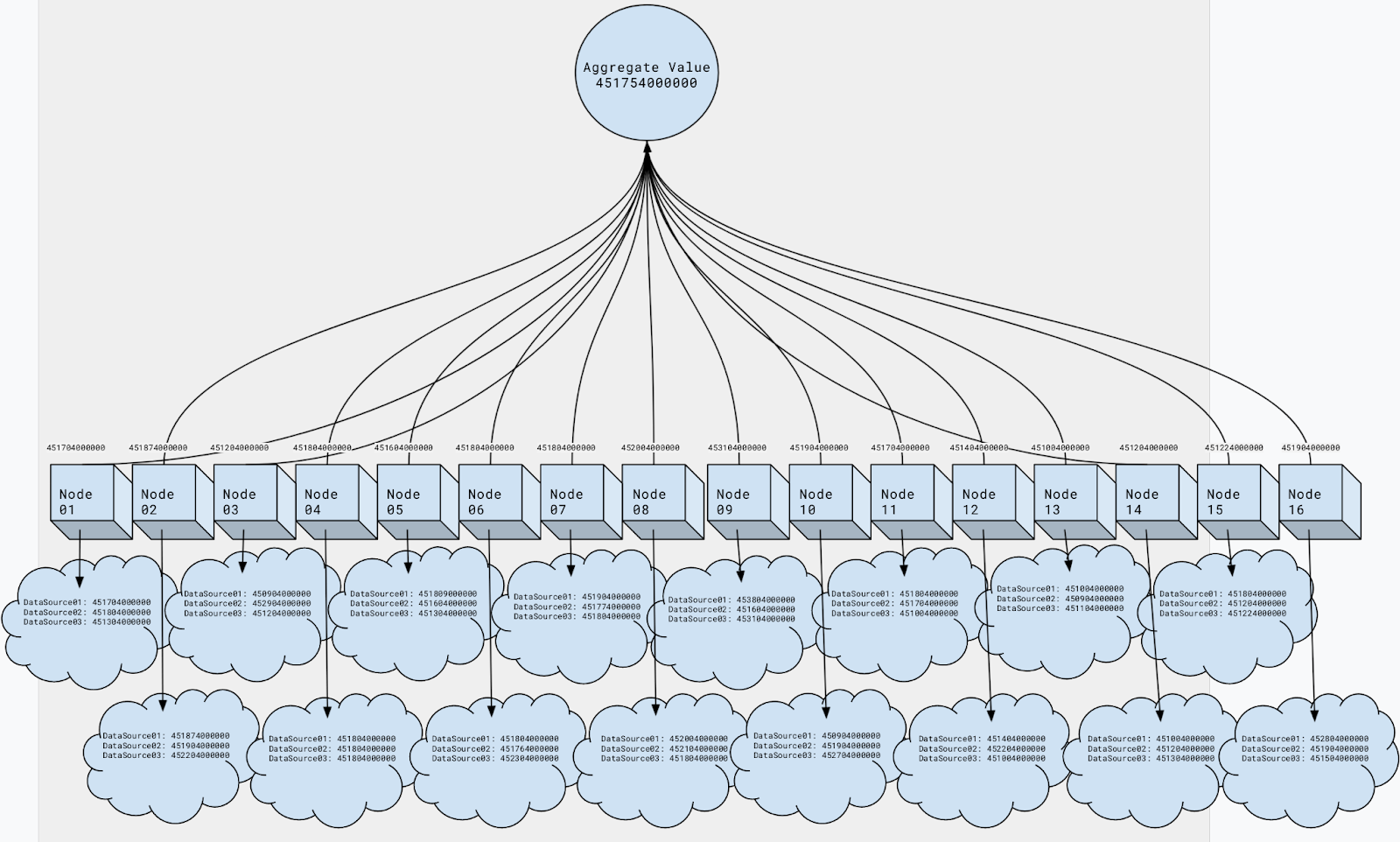

Calculating the Aggregate Value for Each Round

In the following diagram, we can see each of the Chainlink nodes querying three different data sources.

Of these three data sources, each Chainlink node will calculate the median value and report it to the other nodes.

Once a minimum threshold of nodes have reported their values, a median of medians is then calculated.

Each Chainlink node signs the calculated aggregate value.

This aggregated, median of medians, is the value the contract will receive as the latestAnswer

https://www.youtube.com/watch?v=hN91vq6yHRM

Off-chain Reporting resources

Timeline

| Date | Media | Author | Title |

|---|---|---|---|

| 24 Feb 21 | Article | Chainlink | Chainlink Achieves Major Scalability Upgrade With Mainnet Launch of Off-Chain Reporting (OCR) |

Educational

| Date | Media | Author | Title |

|---|---|---|---|

| N/A | Official Docs | Chainlink | Off-Chain Reporting- Official Chainlink Documentation |

| 08 Oct 22 | Video | Chainlink | Looking Under the Hood of OCR 2.0: Product Deep Dive | Lorenz Breidenbach at SmartCon 2022 |

| 24 Feb 21 | Research | Chainlink | Chainlink Off-chain Reporting Protocol |

| Feb 21 | Research | Smart Contract Research Forum | Research Summary - Chainlink Off-Chain Reporting Protocol |

| 27 Jan 21 | Article | Reputation Link | Off-Chain Reporting - Technical Overview |